Introduction

This document contains the data fitting process for the demo dataset included in the LRMoE.jl package. This serves as an example of using the main fitting function fit_LRMoE included in the package.

# Load data

@load "X_obs.jld2" X_obs

@load "Y_obs.jld2" Y_obsFitting LRMoE

In this section, we demonstrate how to fit an LRMoE model in the package. In the current version of LRMoE, the minimal inputs required from the user are: response, covariates, initialization of logit regression coeffecients and component distributions.

# Assume a non-informative guess

α_guess = fill(0.0, 2, 5)

# Correctly specified component distributions

model_guess = [PoissonExpert(10.0) ZIGammaCountExpert(0.50, 40, 0.80);

LogNormalExpert(3.0, 1.0) InverseGaussianExpert(15.0, 15.0)]Now we are ready to call the fitting function. It is optional to print out intermediate updates of parameters.

result_1 = fit_LRMoE(Y_obs, X_obs, α_guess, model_guess)The fitted model can be viewed as follows.

summary(result_1)Model: LRMoE

Fitting converged after 7 iterations

Dimension of response: 2

Number of components: 2

Loglik: -73153.32112999677

Loglik (no penalty): -73147.35233984645

AIC: 146320.7046796929

BIC: 146414.22545854456

Fitted α:

[-0.4317549468937167 1.0687536487401863 -0.0501666562042898 0.0951104899516

9831 1.1966666208577514; 0.0 0.0 0.0 0.0 0.0]

Fitted component distributions:

AnyExpert{LRMoE.NonNegative,z,d} where d<:(Distribution{Univariate,S} where

S<:ValueSupport) where z<:ZeroInflation[PoissonExpert{Float64}(6.016755579

291526) ZIGammaCountExpert{Float64}(0.2061960764035149, 29.956369104025327,

0.4888535921075801); LogNormalExpert{Float64}(4.001049211038016, 0.2967339

201031063) InverseGaussianExpert{Float64}(20.303659308753492, 21.7568654316

48063)]More specifically, the fitted logit regression coefficients and component distributions are given below. We see that the fitting function can correctly identify the true model within reasonable range.

result_1.model_fit.α2×5 Array{Float64,2}:

-0.431755 1.06875 -0.0501667 0.0951105 1.19667

0.0 0.0 0.0 0.0 0.0result_1.model_fit.comp_dist2×2 Array{AnyExpert{LRMoE.NonNegative,z,d} where d<:(Distribution{Univariat

e,S} where S<:ValueSupport) where z<:ZeroInflation,2}:

PoissonExpert{Float64}(6.01676) … ZIGammaCountExpert{Float64

}(0.206196, 29.9564, 0.488854)

LogNormalExpert{Float64}(4.00105, 0.296734) InverseGaussianExpert{Floa

t64}(20.3037, 21.7569)In practice, it is almost impossible to know the true underlying distribution of data. Assume the user has conducted some preliminary analysis, and proposes to use the following LRMoE.

# Assume a non-informative guess

α_guess = fill(0.0, 2, 5)

# Incorrectly specified component distributions

model_guess = [ZIPoissonExpert(0.50, 10.0) ZIPoissonExpert(0.50, 20.0);

BurrExpert(5.0, 2.0, 30.0) GammaExpert(1.0, 10.0)]We call the fitting function similarly as before.

result_2 = fit_LRMoE(Y_obs, X_obs, α_guess, model_guess, penalty=true)summary(result_2)Model: LRMoE

Fitting converged after 29 iterations

Dimension of response: 2

Number of components: 2

Loglik: -74522.97988044818

Loglik (no penalty): -74491.23826492707

AIC: 149010.47652985415

BIC: 149111.19121477133

Fitted α:

[-0.402329688892696 1.0642517348023806 -0.04993352290476096 0.0955025073281

0937 1.1787815897308458; 0.0 0.0 0.0 0.0 0.0]

Fitted component distributions:

AnyExpert{LRMoE.NonNegative,z,d} where d<:(Distribution{Univariate,S} where

S<:ValueSupport) where z<:ZeroInflation[ZIPoissonExpert{Float64}(0.0032705

87671859084, 6.1027631872596455) ZIPoissonExpert{Float64}(0.206265076006209

33, 30.584982151431703); BurrExpert{Float64}(1.3092510512796607, 5.23197932

44529444, 58.7993745083068) GammaExpert{Float64}(1.6243105423038051, 12.398

187227236122)]Fitted Results

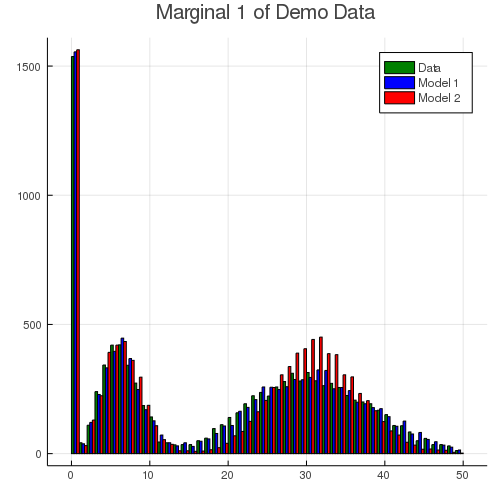

We can visually examine the fitted results of result_1 and result_2. The following histogram compares dimension 1 of the observed data (green) with fitted model 1 (blue) and model 2 (red). Since the true model has a slightly heavy tail due to the gamma-count component, model 2 fails to capture this characteristics with only two Poisson components.

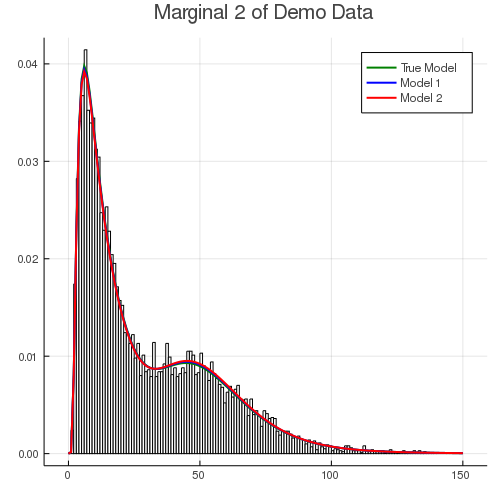

The histogram below shows the fitting result for the second dimension (excluding zero inflation). Both models fit the body of data quite well. This is partly because both Burr and Inverse Gaussian distributions are dense (see Fung et al. (2019)). In other words, they are flexible enough to capture the distribution of response, even under a mis-specified model.

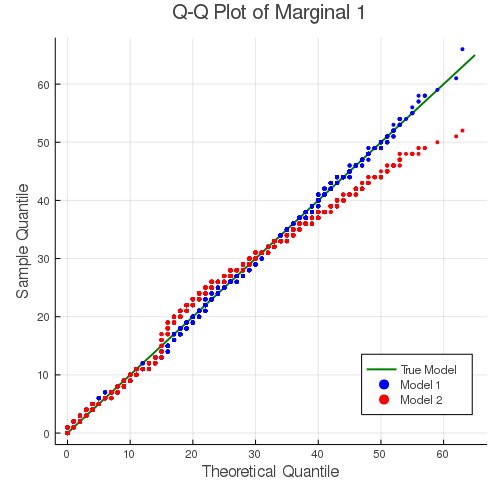

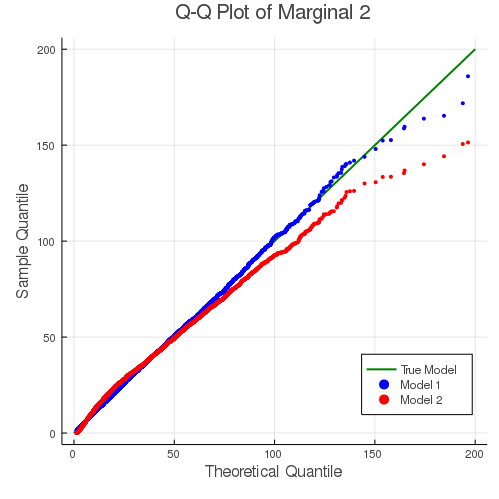

The fitting results can also be demonstrated with the following Q-Q plots. For both dimensions of the response, the mis-specified model 2 gives a slightly worse fit for the tails.